Three Things That Could Secretly Be Hurting Your Credit Score

It is a piece of cake that liens, insolvency, repossession, collections, defaulting on your finances, and so on all seriously damage your credit history.

However, many people are unaware of three less-obvious credit faux pas that can secretly be hurting their credit score.

- Failing to pay what you owe on smaller debts.Yes, as silly as it seems, some of those smaller financial obligations you may have built up overtime in fact do build up as well as can damage your credit rating. Several cities (specifically larger ones where many more offenses take place) turn over tiny fines like unpaid car parking fines as well as unsettled car parking tickets and also library penalties to debt collectors in an initiative to regain a few of the millions of bucks they lose yearly to these unsettled fines.Additionally, not offering your utilities supplier(s) and/or or insurance coverage supplier(s) what they are owed can injure your credit history as well. While these repayments are not typically reported to the national debt reporting companies, many energies and insurance coverage companies will send out delinquent settlement total up to a debt collection agencies instead. These collections agencies then are highly likely to report your delinquent repayment amounts to the national credit coverage firms and also they may see it fit to put a substantial dent in your credit rating.

- Not using your credit cards the right way. Credit history are based mainly on, you presumed it, how you use (or misuse) your credit cards. The reduced your debt-to-credit proportion (additionally known as your “credit rating application”) the better form you remain in. As a result, maxing out your credit cards, or having a higher bank card equilibrium than what your credit line enables, can hike up your credit utilization however kill your credit report score.Closing a few of your older credit cards can be a big mistake as well. Your credit rating plays an essential duty in your credit rating; consequently, shutting some of your older cards makes it appear as though your credit history is shorter and consequently less trusted. Certainly, while eliminating a few of your older cards is not a great idea; neither is applying for a lot of new cards within a short period of time. Doing this boosts the quantity of queries to your credit report which can hurt it over time.

- Having a lack of credit diversity. Your debt should be composed of various kinds of credit and also if it is not, nationwide credit scores coverage firms will probably discover; that is, if they have not observed currently. Having a healthy combination of charge card and also a variety of finances (a house mortgage financing and car being the most usual) shows credit report coverage agencies that you have the ability to tackle a diverse load of credit score and also manage it responsibly.

Your credit rating is among your most important economic properties for doing every little thing from looking for credit cards to getting house and vehicle loans. Do not allow noticeable poor practices or the minimal known poor methods discussed right here keep you from having the ability to obtain what you want.

Securing Your Finances: A 3-Step Guide to Freezing Your Credit

Securing Your Finances: A 3-Step Guide to Freezing Your Credit  Elevate Your Credit Score Quickly: 6 Effective Strategies

Elevate Your Credit Score Quickly: 6 Effective Strategies  Experian’s $650K Fine: Unpacking the Consequences of Spamming Violations

Experian’s $650K Fine: Unpacking the Consequences of Spamming Violations  Safeguarding Patient Privacy: Navigating the Potential Impact of a Healthcare Data Breach

Safeguarding Patient Privacy: Navigating the Potential Impact of a Healthcare Data Breach  Navigating the Surge: Strategies Employed by Medical Credit Card Marketers to Reach Consumers

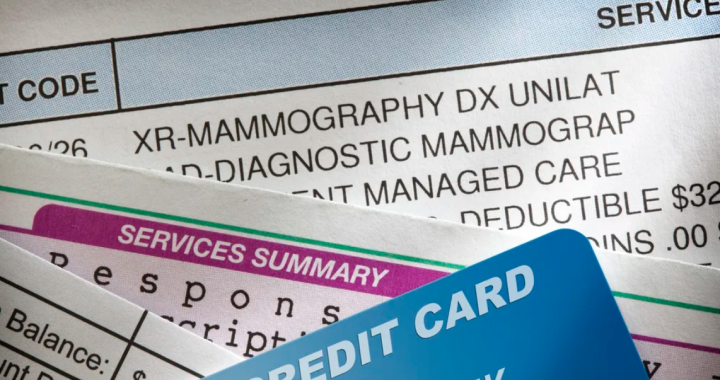

Navigating the Surge: Strategies Employed by Medical Credit Card Marketers to Reach Consumers  Unleashing Financial Awareness: Weekly Access to Permanent Free Credit Reports

Unleashing Financial Awareness: Weekly Access to Permanent Free Credit Reports

Reigniting Your Passion for Charitable Giving: What to Do When the Flame Flickers

Reigniting Your Passion for Charitable Giving: What to Do When the Flame Flickers  Anticipating Savings: How a Landmark Court Case Could Make Home Sellers’ Costs More Affordable

Anticipating Savings: How a Landmark Court Case Could Make Home Sellers’ Costs More Affordable  5 Imperative Facts to Acknowledge Before You Opt for Debt Settlement

5 Imperative Facts to Acknowledge Before You Opt for Debt Settlement  Save Money During the Winter Months with These Easy Tips

Save Money During the Winter Months with These Easy Tips  Credit Rating: How To Improve Credit Rating?

Credit Rating: How To Improve Credit Rating?  Top Property Investment Tips

Top Property Investment Tips  Shifting Tides: The Exodus of Insurance Companies from California

Shifting Tides: The Exodus of Insurance Companies from California  Important Ways You Can Relieve the Financial Pressures of Debt

Important Ways You Can Relieve the Financial Pressures of Debt  A Ray of Relief: $9 Billion More in Student Loan Debt Forgiven

A Ray of Relief: $9 Billion More in Student Loan Debt Forgiven  Navigating Retirement Roads: The Intersection of Student Loan Payments

Navigating Retirement Roads: The Intersection of Student Loan Payments  Reigniting Your Passion for Charitable Giving: What to Do When the Flame Flickers

Reigniting Your Passion for Charitable Giving: What to Do When the Flame Flickers  Walmart’s Healthcare Horizon: Expanding Insurance Reach in Florida

Walmart’s Healthcare Horizon: Expanding Insurance Reach in Florida  Balancing Finances: A Deep Dive into the Best Balance Transfer Credit Cards

Balancing Finances: A Deep Dive into the Best Balance Transfer Credit Cards  How to Save Money on Home Improvements

How to Save Money on Home Improvements