Empower Your Finances: A Guide to Free Credit Report Monitoring

Introduction:

Your credit report is a snapshot of your financial history, and keeping a watchful eye on it is crucial for maintaining a healthy credit score. The good news is that monitoring your credit reports doesn’t have to come with a hefty price tag. In this article, we’ll explore various methods to monitor your credit reports for free, empowering you to stay in control of your financial well-being.

Annual Credit Report: The Foundation of Monitoring: The Fair Credit Reporting Act (FCRA) entitles you to one free credit report from each of the major credit bureaus—Equifax, Experian, and TransUnion—every 12 months. Visit AnnualCreditReport.com to request these reports. Rotating between the three bureaus allows you to check your credit for free every four months.

Weekly Access Through CARES Act Provisions: In response to the economic challenges brought on by the COVID-19 pandemic, the CARES Act has temporarily granted consumers the right to access their credit reports weekly for free. This provision extends until April 2023. Seizing this opportunity provides a more frequent and dynamic view of your credit standing.

Credit Monitoring Apps and Services: Several financial institutions and independent services offer free credit monitoring apps. These apps provide real-time updates on changes to your credit report, such as new accounts, late payments, or credit inquiries. Explore apps like Credit Karma, Credit Sesame, or your bank’s credit monitoring service for convenient access.

Credit Card Benefits: Some credit card issuers provide free credit score monitoring as a cardholder benefit. Check with your credit card company to see if they offer this service. It’s a convenient way to keep tabs on your credit score and receive alerts for any significant changes.

Set Up Fraud Alerts: Placing a fraud alert on your credit reports is an additional layer of protection. When a fraud alert is in place, creditors must take extra steps to verify your identity before extending credit. You can place a fraud alert with one bureau, and they will notify the other two.

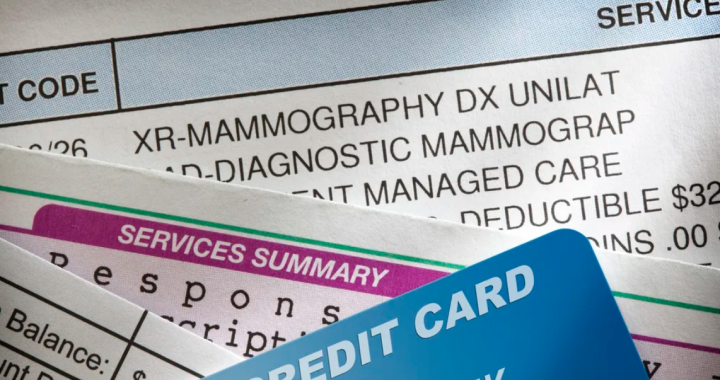

Reviewing Statements and Credit Card Activity: Regularly reviewing your monthly credit card statements is a simple yet effective way to monitor your financial activity. Check for any unauthorized transactions and ensure that the reported balances align with your records. Timely identification of discrepancies can prevent potential damage to your credit.

Utilize Credit Score Apps: Many financial institutions and credit bureaus offer free credit score monitoring apps. These apps provide insights into factors influencing your credit score and offer tips on how to improve it. Familiarize yourself with the factors that contribute to your score and take proactive steps to enhance your creditworthiness.

Correcting Errors Promptly: If you spot errors on your credit report, address them promptly. Dispute inaccurate information with the credit bureau reporting the error. Timely resolution ensures that your credit report accurately reflects your financial history, preventing unnecessary complications in the future.

Conclusion:

Monitoring your credit reports for free is a proactive and empowering practice that safeguards your financial health. Whether you opt for the annual free reports, leverage the CARES Act provisions, explore credit monitoring apps, or utilize credit card benefits, staying informed is key. Regularly checking your credit reports not only helps you detect and address errors but also allows you to make informed decisions to enhance your overall financial well-being.

Securing Your Finances: A 3-Step Guide to Freezing Your Credit

Securing Your Finances: A 3-Step Guide to Freezing Your Credit  Elevate Your Credit Score Quickly: 6 Effective Strategies

Elevate Your Credit Score Quickly: 6 Effective Strategies  Experian’s $650K Fine: Unpacking the Consequences of Spamming Violations

Experian’s $650K Fine: Unpacking the Consequences of Spamming Violations  Safeguarding Patient Privacy: Navigating the Potential Impact of a Healthcare Data Breach

Safeguarding Patient Privacy: Navigating the Potential Impact of a Healthcare Data Breach  Navigating the Surge: Strategies Employed by Medical Credit Card Marketers to Reach Consumers

Navigating the Surge: Strategies Employed by Medical Credit Card Marketers to Reach Consumers  Unleashing Financial Awareness: Weekly Access to Permanent Free Credit Reports

Unleashing Financial Awareness: Weekly Access to Permanent Free Credit Reports

Reigniting Your Passion for Charitable Giving: What to Do When the Flame Flickers

Reigniting Your Passion for Charitable Giving: What to Do When the Flame Flickers  Anticipating Savings: How a Landmark Court Case Could Make Home Sellers’ Costs More Affordable

Anticipating Savings: How a Landmark Court Case Could Make Home Sellers’ Costs More Affordable  5 Imperative Facts to Acknowledge Before You Opt for Debt Settlement

5 Imperative Facts to Acknowledge Before You Opt for Debt Settlement  Save Money During the Winter Months with These Easy Tips

Save Money During the Winter Months with These Easy Tips  Credit Rating: How To Improve Credit Rating?

Credit Rating: How To Improve Credit Rating?  Top Property Investment Tips

Top Property Investment Tips  Walmart’s Healthcare Horizon: Expanding Insurance Reach in Florida

Walmart’s Healthcare Horizon: Expanding Insurance Reach in Florida  What Costs are Associated With a Mortgage?

What Costs are Associated With a Mortgage?  Stock Market Recap: Mixed Finishes Amid Stabilizing Treasury Yields

Stock Market Recap: Mixed Finishes Amid Stabilizing Treasury Yields  Final Approval Granted for $725M Facebook Settlement – A Landmark Resolution for Privacy Claims

Final Approval Granted for $725M Facebook Settlement – A Landmark Resolution for Privacy Claims  Sollers Announces $3.4 Million Student Loan Debt Cancellation Amid Deceptive Practice Charges

Sollers Announces $3.4 Million Student Loan Debt Cancellation Amid Deceptive Practice Charges  Smart Shopper’s Guide: 10 Money-Saving Hacks for Amazon

Smart Shopper’s Guide: 10 Money-Saving Hacks for Amazon  Interest Rates Forecast: Why Rates Are Nearing Their Peak

Interest Rates Forecast: Why Rates Are Nearing Their Peak  The Hidden Dilemma: How Soaring Healthcare Costs Impact Even the Insured, Leading to Skipped Care

The Hidden Dilemma: How Soaring Healthcare Costs Impact Even the Insured, Leading to Skipped Care